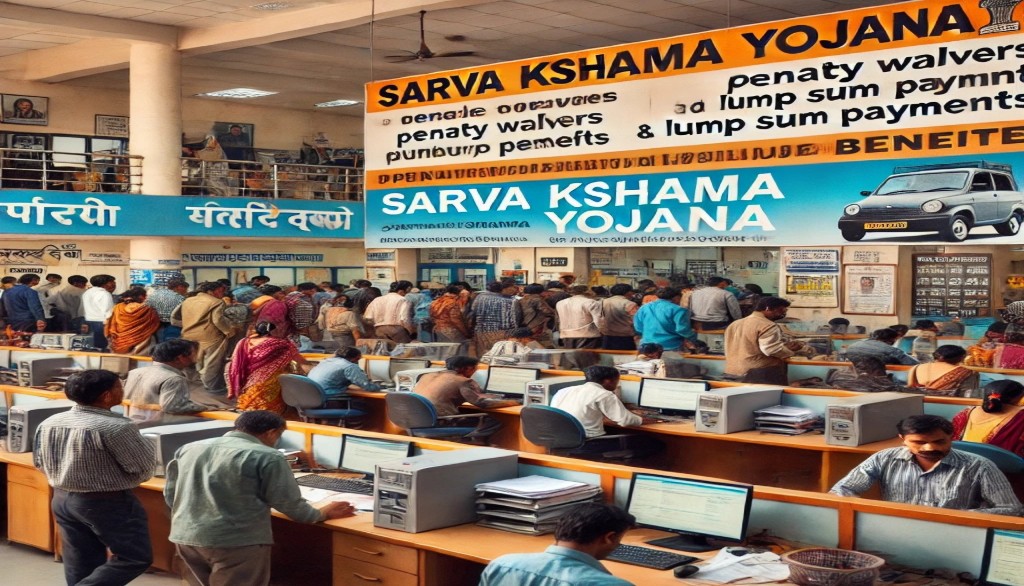

Final Call for Tax Defaulters: Sarva Kshama Yojana Deadline Nears

Patna : Vehicle owners who have defaulted on their taxes have just five days left to take advantage of the Sarva Kshama Yojana, a scheme offering exemptions on penalties and interest for lump sum payments. The scheme, which has been running since September 18, 2024, will end on March 31.

According to Transport Secretary Sanjay Kumar Aggarwal, this is the last opportunity for vehicle owners and traders to clear outstanding taxes without facing additional financial penalties. “This is a golden opportunity for all tax defaulter vehicle owners and traders. Those who have not yet cleared their dues can avoid financial penalties by paying the outstanding amount in one go,” Aggarwal said.

Relief for Multiple Categories of Defaulters

The Sarva Kshama Yojana offers relief on various types of outstanding payments, including:

- Toll and Green Tax

- Temporary Registration Fees

- Trade Tax Levied per Vehicle on Trade Certificates

Tax defaulters who own registered and unregistered vehicles, including tractor-trailers and battery-operated (electric) vehicles, can benefit from this scheme. Dealers with unpaid trade tax are also eligible for exemptions.

Waivers on Penalties for Lump Sum Payments

The scheme offers universal exemption from penalties for those paying a lump sum of Rs 30,000 on dues related to tractor-trailers. Similarly, registered and unregistered vehicle owners, along with battery-operated vehicle owners, can clear their dues by paying the basic toll and 30% of the penalty.